Personal Loans

Personal Loan Payoff Calculator — Plan Payments, Cut Interest, Become Debt-Free Faster

This hands-on guide shows you exactly how personal loan payoff works in the U.S. market, how to

calculate it manually, and smart ways to finish early without overpaying in interest. You’ll also find

side-by-side lender comparisons, real examples with extra payments and lump sums, and common pitfalls to avoid

Free & Accurate

No sign-up

Extra & Lump-Sum Scenarios

CSV Amortization

What you’ll learn

- How payoff is calculated (interest vs. principal) and how to do it manually.

- How extra monthly payments and one-time lump sums change your payoff date.

- Which lenders charge origination fees and whether there’s an early-payoff penalty.

Who this guide is for

- Borrowers planning a new personal loan and comparing rates & fees.

- Anyone aiming to pay off early without wasting money on interest.

- People consolidating credit card debt and testing payoff scenarios first.

Want to try scenarios as you read? Jump to the calculator section below to model extra payments or a

lump sum—then come back for the step-by-step breakdown.

Go to calculator ↓

What is a Personal Loan Payoff Calculator?

A personal loan payoff calculator is a tool that shows you three critical pieces of information:

your monthly payment, how much of it goes to principal vs. interest, and the exact payoff date.

Instead of guessing, you can see precisely how long it will take to be debt-free and how much interest you’ll pay along the way.

Principal

The amount you originally borrowed. Each monthly payment reduces this balance until it reaches zero.

Interest

The cost of borrowing, shown as APR. The calculator reveals how much of your payment goes to the lender.

Payoff Date

The exact month and year your loan will be fully paid off, assuming the chosen payment schedule.

🔎 Unlike a credit card payoff calculator (which often deals with revolving balances)

or a mortgage payoff calculator (focused on 15–30 year home loans),

the personal loan version is designed for fixed-term, fixed-rate loans typically lasting 2–7 years.

Scenarios You Can Test

- Regular monthly payments — shows your standard payoff timeline.

- Extra monthly payments — see how $50 or $100 extra can cut years off your loan.

- Lump sum payment — test the impact of paying a tax refund or bonus toward your balance.

- Early payoff scenarios — model becoming debt-free months or years ahead of schedule.

✅ Tip: Run multiple scenarios. Even a small extra monthly payment can save you thousands in interest

and bring your payoff date much closer than you expect.

How to Calculate a Personal Loan Payoff Manually

Fixed-rate personal loans use standard amortization. The monthly payment depends on the balance

(P), the monthly interest rate (r = APR/12), and the total number of months (n).

M = P × r / (1 − (1 + r)−n) Where: P = loan amount, r = APR/12, n = number of months

Worked Example

- Loan amount (P): $10,000

- APR: 8% → r: 0.08/12 = 0.0066667

- Term (n): 60 months (5 years)

- Monthly payment (M): ≈ $202.76

- Total paid: ~$12,165.84 → Total interest: ~$2,165.84

Tip: You can also solve for n (months to pay off) when you choose a higher monthly payment:

n = −ln(1 − r·P/M) / ln(1 + r).

This shows how faster payments shrink your timeline.

Scenario Comparison (Same APR 8%)

| Scenario | Monthly Payment | Payoff Time | Total Interest | Saved vs. Regular |

|---|---|---|---|---|

| Regular monthly payments | $202.76 | 60 months | $2,165.84 | — |

| +$100 extra each month | $302.76 | 38 months (≈ 22 months faster) | $1,332.90 | $832.94 less interest |

| Lump sum $1,000 after year 2 | $202.76 | 54 months (≈ 6 months faster) | $1,917.35 | $248.48 less interest |

Numbers rounded for clarity. Actual results depend on your lender’s compounding conventions and exact payment dates.

Use the calculator below to model your own schedule and export the full amortization table (CSV).

Personal Loan Rates & Fees — Side-by-Side Comparison

Small differences in APR or a one-time origination fee can change your total interest by hundreds or even thousands of dollars

over the life of a loan. Use the table below to compare common ranges, then test scenarios in the calculator.

| Bank / Lender | APR Range | Loan Amounts | Term | Origination Fees | Early Payoff Penalty |

|---|---|---|---|---|---|

| Wells Fargo | 6.99%–24% | $3,000–$100,000 | 12–84 mo | None | No |

| Discover | 7.99%–24% | $2,500–$40,000 | 36–84 mo | None | No |

| SoFi | 6.99%–23% | $5,000–$100,000 | 24–84 mo | None | No |

| Marcus (Goldman Sachs) | 6.99%–19% | $3,500–$40,000 | 36–72 mo | None | No |

| LendingClub | 8.30%–36% | $1,000–$40,000 | 24–60 mo | 2–6% | No |

Why it matters: A 0.50% APR difference on a $20,000 loan over 60 months can mean hundreds of dollars in extra interest.

An origination fee of 5% adds $1,000 to your cost on day one—before you make a single payment.

- Prefer no-fee lenders when APRs are similar.

- Match term length to your budget—shorter terms save interest.

- Confirm there’s no prepayment penalty before planning early payoff.

Compare two lenders head-to-head and see the impact of fees or a 0.5% APR change in seconds —

try the calculator below.

Ranges shown are illustrative and may vary by credit profile, state, autopay discounts, and lender updates. Always check current terms on the lender’s website.

Next Step: Test Your Options

See how APR, fees, and extra payments change your payoff time and total interest—then pick the plan that fits your budget.

No sign-up required. Educational estimates only—confirm terms with your lender.

Early Payoff Strategies for Personal Loans

Paying off a personal loan faster can save you thousands in interest. Here are proven strategies you can test with our

personal loan payoff calculator.

1. Extra Monthly Payments

Even adding $50–$100 extra to your monthly payment can shorten your payoff timeline by years.

Example: A $15,000 loan at 9% APR (5 years) costs ~$3,655 in interest.

With $100 extra each month, you finish 17 months earlier and save over $1,000.

2. Lump Sum Payments

Tax refund? Work bonus? A one-time $1,000 lump sum early in your loan can cut several months off and

reduce total interest significantly. The earlier you apply it, the bigger the impact.

3. Bi-Weekly Schedule

Switching from 12 monthly payments to 26 half-payments (every two weeks) results in

13 full payments per year instead of 12. That extra payment shaves time off your loan

automatically without a big change to your budget.

4. Debt Snowball vs. Avalanche

If you have multiple debts, payoff strategy matters:

- Snowball: Pay off the smallest balance first for motivation.

- Avalanche: Target the highest APR first for maximum savings.

Learn more: Investopedia – Snowball vs. Avalanche

✅ Combine these strategies: A small extra monthly payment + one lump sum + a bi-weekly plan

can cut years off your payoff. Use the calculator to model different mixes and choose the best fit.

Personal Loans vs. Credit Cards vs. Mortgage — What’s Best and When?

Each product serves a different purpose. As a rule of thumb in the U.S., mortgages have the lowest rates (secured by your home),

personal loans sit in the middle (fixed term, unsecured), while credit cards usually carry the highest APRs (revolving debt).

Use the insights below—and verify savings with our personal loan payoff calculator.

| Product | Typical APR | Secured? | Term / Nature | Best Use Cases |

|---|---|---|---|---|

| Personal Loan | ~6%–24%+ | No (unsecured) | Fixed payment, 2–7 years | Debt consolidation, large expenses, predictable payoff |

| Credit Card | ~18%–30%+ | No (revolving) | Flexible, no fixed end date; minimums extend payoff | Short-term purchases, rewards—not for carrying balances |

| Mortgage / Home Equity | ~5%–8% (varies) | Yes (home) | Long term, 10–30 years (fixed/ARM) | Home purchase or improvements; lower rates but closing costs |

When to choose a Personal Loan over a Credit Card

- You need $3k–$40k+ and want a fixed payoff date.

- Your card APR is ~20%+, but you can qualify for a lower personal loan APR.

- You’re consolidating multiple balances into one predictable payment.

Why rates rank: Mortgage < Personal Loan < Credit Card

Mortgages are secured by your home—lower risk, lower APR. Credit cards are unsecured, high risk—highest APR.

Personal loans sit in the middle: unsecured but with fixed, fully-amortized payments.

Real-World Cost Example — $10,000 over 60 months

| Product (APR) | Monthly Payment | Months | Total Interest |

|---|---|---|---|

| Credit Card (22%) — amortized | $276.19 | 60 | $6,571 |

| Personal Loan (10%) | $212.47 | 60 | $2,748 |

| Mortgage/HE (6%) — illustrative | $193.33 | 60 | $1,600 |

Figures rounded for clarity. Credit card rows assume you fully amortize a $10k balance over 60 months;

minimum payments on cards often extend payoff much longer and cost more interest.

Mortgage numbers shown for illustration—closing costs and collateral risk apply.

✅ If you’re carrying credit card balances above ~20% APR, a lower-rate personal loan with a fixed term can

lock in a clear payoff date and save thousands—especially if you add small extra payments or a lump sum.

Often cuts 12–24 months off your payoff.

Bigger impact when paid in the first half.

One extra full payment automatically.

Personal Loan Payoff Calculator — Interactive Guide

Follow these quick steps to model your payoff and test early-payoff tactics (extra payments & lump sums).

① Enter your basics

- Balance (USD): total amount you owe.

- APR (%): annual percentage rate from your loan agreement.

- Term (months): remaining months (or original term if new).

② Advanced options

- Extra Monthly (USD): add a fixed extra to every payment.

- Lump Sum: choose the month & amount for a one-time prepayment.

- Bi-weekly: switch to ~13 full payments/year automatically.

Example baseline we’ll use below: $20,000 balance, 10% APR, 60 months.

Baseline (no extras)

- Monthly payment: ~$424.94

- Payoff time: 60 months

- Total interest: ~$5,496.45

Add $200 per month

- New monthly payment: ~$624.94

- New payoff time: ≈ 38 months (about 22 months faster)

- Total interest: ~$3,359.40 → save ~$2,137.05

✅ Best for steady cash flow—turn small monthly discipline into large interest savings.

Lump sum $5,000 (after month 12)

- Monthly payment stays: ~$424.94

- New payoff time: ≈ 44 months (about 16 months faster)

- Total interest: ~$3,517.20 → save ~$1,979.26

💡 Bigger impact when paid earlier (e.g., tax refund or annual bonus in year 1).

| Scenario | Monthly Pay | Months | Total Interest |

|---|---|---|---|

| Baseline | $424.94 | 60 | $5,496.45 |

| +$200/month | $624.94 | 38 | $3,359.40 |

| $5,000 lump (month 12) | $424.94 | 44 | $3,517.20 |

Figures rounded for readability. Actual results vary by lender compounding and exact payment dates.

Model your own numbers below and export the full amortization schedule (CSV).

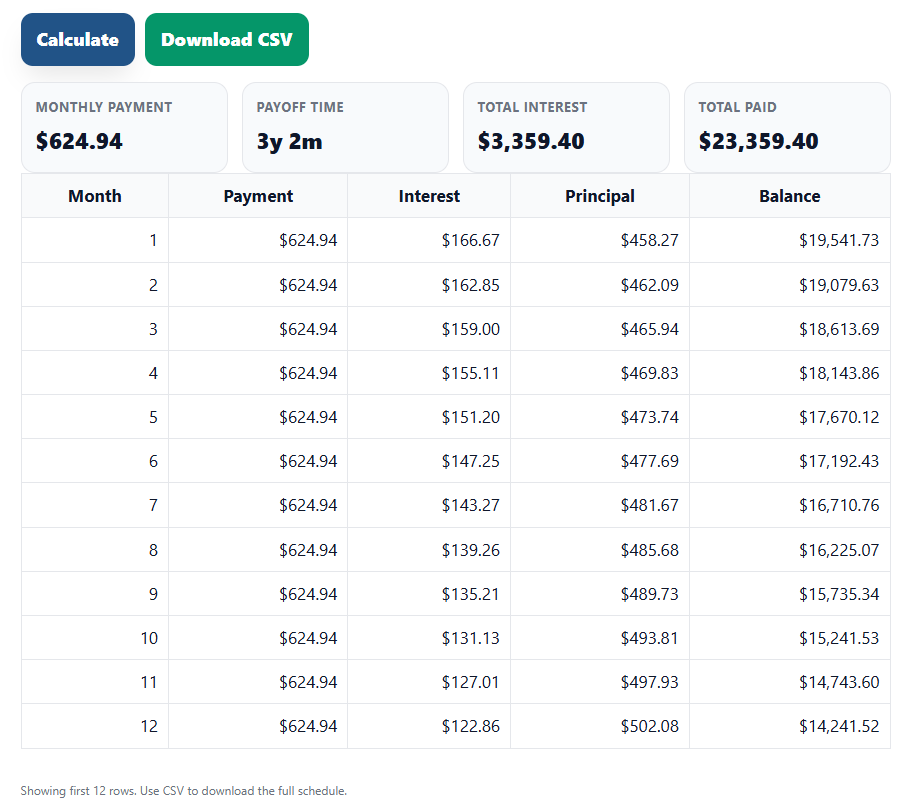

Loan Payoff Early Calculator — Example with Extra Payments

Here’s what happens when you add $200 extra per month to a $20,000 loan at 10% APR over 5 years.

Calculator output: payoff in 3y 2m with ~$3,359 in total interest.

Calculator output: payoff in 3y 2m with ~$3,359 in total interest.✅ Monthly payment rises to $624.94

✅ Loan paid off in 3 years 2 months (22 months faster)

✅ Interest cut from ~$5,496 to ~$3,359 → save about $2,137

Practical Tips for American Borrowers

Before taking on a personal loan, consider these proven strategies to avoid costly mistakes and save money over the life of your loan:

- 🚫 Avoid loans with APR above 20% — high interest can double your payoff cost.

- ⚠️ Never take a personal loan to pay off another personal loan; it traps you in a debt cycle.

- 💡 Always try early payoff when you get a bonus, tax refund, or extra income.

- 🔍 Check if your lender charges penalties for early payoff before signing the contract.

- ✅ Use our Personal Loan Payoff Calculator before you commit to see the real cost of your loan.

Personal Loan – FAQs

Quick answers to common questions about personal loans, early payoff, rates, and using our personal loan payoff calculator.

1) What is a personal loan?

It’s an unsecured installment loan with a fixed APR and a set repayment term (usually 2–7 years). You repay in equal monthly payments until the balance reaches zero.

2) Does paying off a personal loan early reduce interest?

Yes. Interest accrues on the remaining balance. Paying early reduces the balance sooner, which lowers total interest paid over the life of the loan.

3) Are there penalties for early payoff?

Many lenders don’t charge prepayment penalties, but some do. Always check your loan agreement for “prepayment penalty” or “early payoff fee”.

4) Personal loan vs. credit card—when should I use each?

Use a personal loan for larger amounts and a clear payoff date. Credit cards are best for short-term purchases paid in full each month; carrying a balance often costs more.

5) How much can I borrow?

Common ranges are $1,000–$100,000 depending on credit, income, and lender policies. Higher credit scores and stable income usually qualify for larger amounts and lower APRs.

6) How does a personal loan affect my credit score?

Application may cause a hard inquiry (small, temporary dip). On-time payments help build credit. Late payments or default harm your score.

7) What APR is considered good for a personal loan?

It varies by credit profile and market, but single-digit APRs are generally strong; try to avoid APRs above ~20% whenever possible.

8) What fees should I look for?

Origination fees (often 0–6%), late fees, and potential prepayment penalties. Compare “APR” not just the nominal rate, and read the fee section carefully.

9) Fixed vs. variable APR—what’s the difference?

Fixed APR stays the same for the term; payments are predictable. Variable APR can change with market rates, which may raise or lower your payment and total cost.

10) How do extra monthly payments work?

Any amount you pay above the scheduled payment should be applied to principal. This shortens your payoff time and reduces interest—confirm your lender applies extras to principal.

11) Is a lump-sum prepayment better than small extras?

Both help. A lump sum early in the term often has a big impact at once; consistent extra payments compound month after month. You can combine both.

12) What is a bi-weekly payment schedule?

Instead of 12 monthly payments, you make 26 half-payments—about 13 full payments per year—cutting time and interest automatically.

13) Can I use a personal loan to consolidate credit card debt?

Yes, if you qualify for a lower APR and keep cards paid off afterward. Consolidation without behavior change may lead back to debt.

14) Will refinancing a personal loan save me money?

Possibly—if you secure a lower APR or shorter term without high fees. Compare offers with total cost (interest + fees), not just the payment.

15) How do I estimate my monthly payment manually?

Use M = P×r / (1 − (1+r)−n) where P is balance, r is APR/12, n is months. Or use our calculator for instant results.

16) Do personal loans have variable monthly payments?

Typically no—most are fixed-payment, fully amortized loans. Your payment stays the same each month unless you choose to pay extra.

17) Is there a minimum credit score for approval?

Lenders set their own thresholds. Prime offers generally start around the mid-600s and above, but underwriting looks at income, debt-to-income, and history too.

18) Should I check rates with multiple lenders?

Yes. Pre-qualification with a soft pull won’t affect your score and helps you compare APRs and fees. Choose the lowest total cost—then plan an early payoff.

Conclusion

Personal loans can be powerful financial tools if managed wisely.

Our payoff calculator helps you see exactly how much interest you can save and how quickly you can be debt-free.

📚 For more official information on personal loans and consumer protections, visit:

CFPB – Consumer Financial Protection Bureau

Federal Student Aid (U.S. Dept. of Education)