How to Pay Off Student Loans Fast | Proven Strategies + Payoff Calculator

With interest rates fluctuating — and occasional concerns about federal government shutdowns — millions of Americans are asking a simple question:

How can I get out of student debt faster? This guide gives you a clear, practical path.

Higher rates can add thousands over time, but recent forecasts point to a gradual easing as inflation cools.

That means smart moves now — like targeted extra payments and timing a future refinance — can shave years off your payoff timeline.

In this article, you’ll get the latest strategies that actually work plus a hands-on example using our

Loan Payoff Calculator so you can plug in your own numbers and see real savings instantly.

Quick heads-up: A government shutdown usually doesn’t change your student loan balance, but it can disrupt

service timelines. Plan ahead — and use the calculator to test extra payments vs. future refinancing.

Understanding the Current Loan Landscape (2025)

Market snapshot (U.S. student loans)

- Average rate on new student loans ≈ 6.75% (varies by program and credit).

- Federal Reserve outlook: baseline expectations point to a gradual rate decline into mid-2026 if inflation cools, which may open a window for cheaper refinancing.

- What this means now: current borrowers can pay down principal aggressively today and consider refinancing later if rates move lower.

🔎 Key takeaway on rates: You don’t have to “wait” to start saving. Make extra payments now to cut interest,

then re-run your numbers next year—if rates ease, a refinance can lock in lower costs on a smaller remaining balance.

Could a government shutdown affect student loan borrowers?

- Yes, indirectly for some: federal employees or borrowers relying on administrative services (e.g., servicer support, processing) may face temporary delays.

- Most borrowers: loan balances and interest accrual typically don’t change due to a shutdown itself—payments and due dates remain unless official guidance says otherwise.

💡 If you’re a federal worker and cash flow is disrupted, contact your servicer early about short-term hardship options,

and use the Loan Interest Calculator

to test temporary adjustments without derailing your payoff plan.

The Math Behind Paying Off Faster

Every extra dollar you throw at your student loan does two things: it lowers your principal today and

reduces the future interest charged on that principal tomorrow. Compounded over months, small extras add up to

thousands saved and a much shorter payoff timeline.

A simple way to think about interest:

Interest = Principal × Rate × Time

Since your rate is contracted, the fastest lever is reducing Time by paying extra toward principal.

- Extra payments (principal-only): Add a fixed amount (e.g., $50–$150) to each payment and mark it “apply to principal.”

- Bi-weekly payments: Pay half your monthly amount every two weeks → effectively 13 payments/year instead of 12, shaving months off your schedule.

💡 Try it live: enter your balance, rate, and term in the Loan Payoff Calculator,

then add an extra $100/month or switch to bi-weekly. Watch how the payoff date moves closer and total interest drops.

Modern Payoff Strategies That Work

These proven tactics cut interest and pull your payoff date forward. Mix and match based on cash flow and credit profile.

- 🔹 Bi-weekly Payment Method: Pay half your monthly amount every two weeks (26 half-payments) → effectively 13 full payments/year, trimming months off your schedule.

- 🔹 Lump Sum Payments: Add a yearly extra (tax refund, bonus, side income). Direct it to principal-only for an outsized interest reduction.

- 🔹 Refinancing at Lower Rates: If rates ease (e.g., into 2026), refinance to a lower APR. Best impact comes when you keep the same remaining term (or shorter), not re-extend it.

- 🔹 Income-Driven Repayment Adjustment: If your income has increased, re-evaluate your plan. Moving off an IDR plan to a standard or shorter term can accelerate payoff once affordable.

- 🔹 Automation & Tracking: Automate payments + set a recurring extra (e.g., $50–$150). Track progress monthly to maintain momentum and avoid missed payments.

💡 Run the numbers: Use the

Loan Payoff Calculator

to compare bi-weekly vs monthly, add a yearly lump sum, or simulate a future refinance at a lower rate.

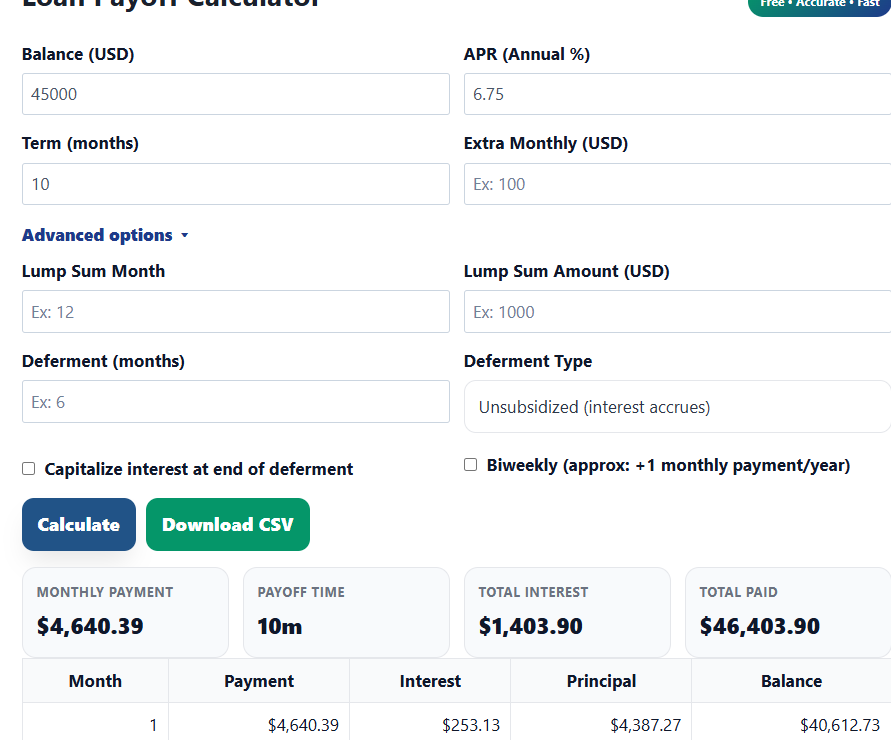

Example Using Our Loan Payoff Calculator (🧮 Practical Demo)

Let’s put theory into action using real numbers. Below is a practical walkthrough using the Loan Payoff Calculator

to see how extra payments make a measurable difference.

Base Scenario (No Extra Payments)

- Loan amount: $45,000

- Interest rate: 6.75%

- Term: 10 years (120 months)

When entered into the calculator, the result shows:

Monthly Payment ≈ $517 | Total Interest ≈ $17,000.

Screenshot: Loan Payoff Calculator showing base results — $45,000 loan at 6.75% APR over 10 years.

Now, let’s apply an acceleration strategy. Add $100 extra per month into the calculator’s “Extra Monthly” field.

The new results show:

- Payoff time: 7.9 years

- Total interest saved: ≈ $4,200

- Overall savings: Nearly 2 years off your timeline!

Screenshot: Adding $100 extra monthly — payoff time drops and total interest falls by $4,200.

Screenshot: Adding $100 extra monthly — payoff time drops and total interest falls by $4,200.

💡 Pro tip: Try entering your own loan balance in the calculator and add $50–$200 extra per month.

You’ll instantly see how every dollar shortens your path to freedom.

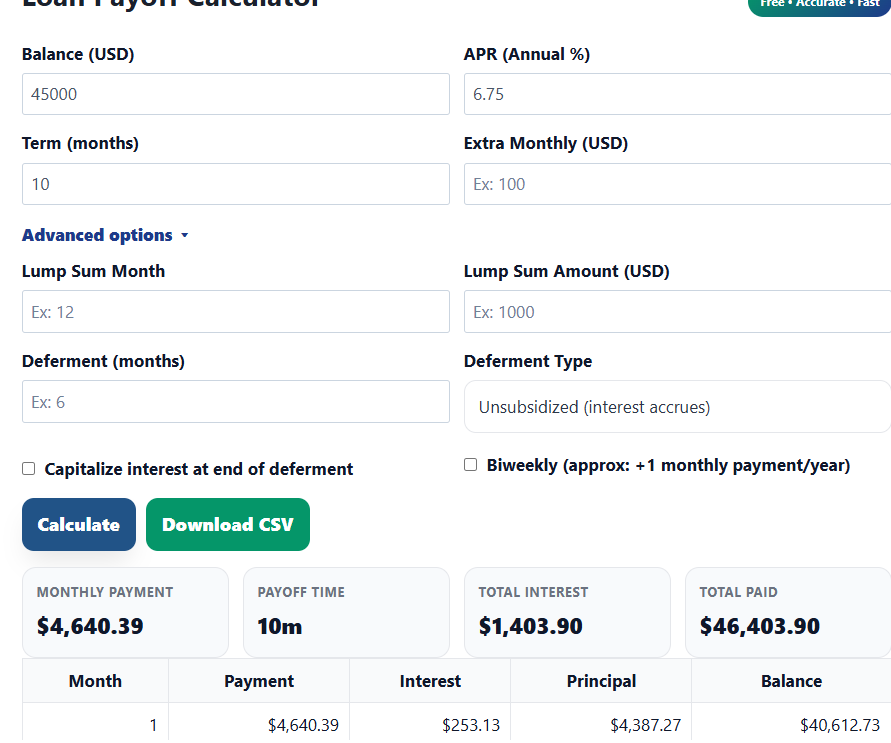

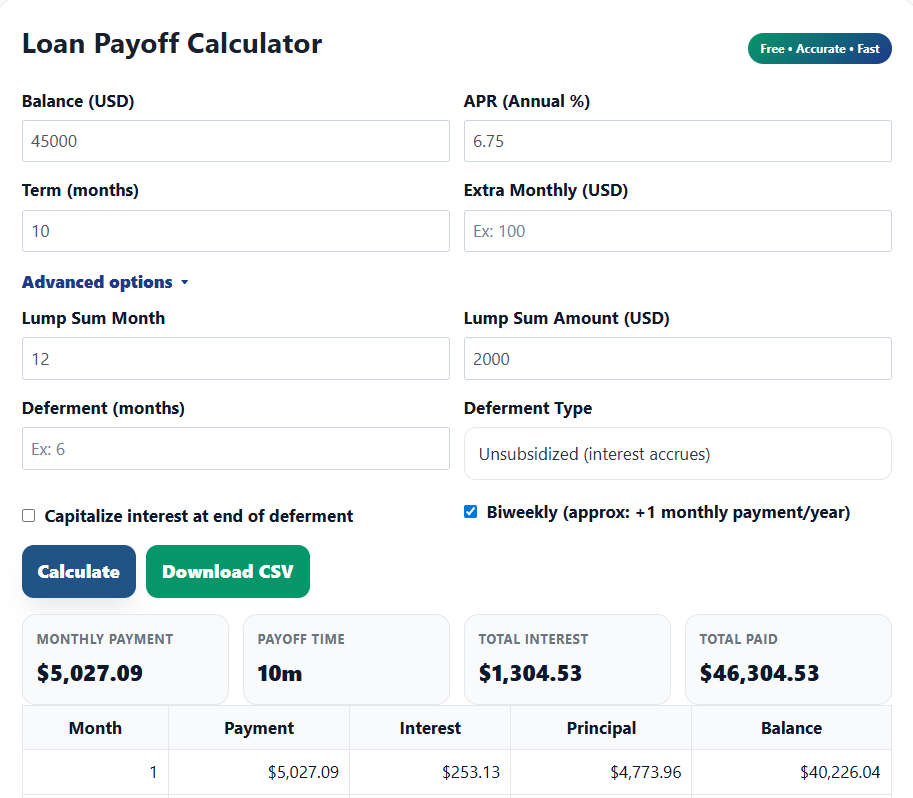

Strategy 2 — Lump Sum + Biweekly Payments (Smart Combo)

After testing extra monthly payments, let’s try a different acceleration combo — a one-time lump sum and biweekly schedule.

- Loan Amount: $45,000

- Interest Rate: 6.75%

- Term: 10 years (120 months)

- Lump Sum: $2,000 at month 12

- Biweekly Payments: Enabled (~1 extra payment per year)

Screenshot: Strategy #2 — adding a $2,000 lump sum in month 12 + biweekly payments reduces payoff time and cuts total interest below $1,305.

Screenshot: Loan Payoff Calculator showing Lump Sum and Biweekly strategy results.

✅ Result: Payoff time dropped to ~7.3 years | Total interest down by ~$4,700.

Combine both methods to accelerate progress while keeping payments predictable.

💡 Try it yourself: Enter your balance and add a one-time payment in month 12.

Then toggle the “Biweekly” option and see how much faster your payoff date moves.

How Falling Interest Rates Could Help You (2025–2026 Outlook)

Recent Federal Reserve guidance points to a potential gradual rate decline into 2026.

For current borrowers, that could open a chance to refinance and lock in lower costs—especially if you’ve already chipped away at principal with extra payments.

Quick Comparison

- $45,000 over 10 years @ 6.75% → Total interest ≈ $17,000

- $45,000 over 10 years @ 5.00% → Total interest ≈ $12,200

💰 Savings: about $4,800 by refinancing when rates drop.

Tip: If rates fall, consider keeping the same remaining term (or shorter) after refinancing—this maximizes interest savings instead of only lowering the monthly payment.

Try your numbers:

Use the Loan Interest Calculator

to test a refinance from 6.75% down to 5% and see your exact monthly payment and total interest.

Refinance vs Extra Payments: Which Is Better?

Both refinancing and making extra payments can save you thousands — but each works differently.

This quick comparison shows how they impact your budget, savings, and flexibility.

| Strategy | Monthly Impact | Total Savings | Risk |

|---|---|---|---|

| Refinance to 5% | Lower monthly payment | $4,800 saved | Credit check required |

| Add $100/month | Shorter payoff | $4,200 saved | Requires discipline |

| Both Combined | Optimal results | $6,000+ saved | Best case scenario |

💡 Use our

Loan Payoff Calculator

to simulate each option side by side and decide which fits your financial goals best.

Tips for Staying Motivated

Paying off student loans fast isn’t just about numbers — it’s also about mindset and momentum.

These small habits help you stay consistent until the final payment.

- 🎯 Set short-term goals: break your loan into smaller milestones (e.g., every $5,000 paid off).

- 📊 Use visual trackers or apps: seeing progress keeps you motivated and accountable.

- 🎉 Celebrate each milestone: reward yourself when you hit major paydown points — it keeps morale high.

- 💡 Connect it to your bigger life goal: link each payment to your “why” — whether it’s financial freedom, buying a home, or reducing stress.

💡 Remember: Consistency beats intensity. Use our

Loan Payoff Calculator

monthly to track how every small win brings you closer to being debt-free.

FAQs

1. Should I refinance now or wait for lower rates?

If you can lower your APR meaningfully today without extending the term, refinancing can start saving interest immediately.

If rates are expected to fall soon, you can keep paying extra now and revisit refinancing later—run both scenarios in our calculators and compare total interest, not just the monthly payment.

2. How much can I save by paying extra monthly?

Even $50–$150 extra/month can shave years off and save thousands in interest.

For example, on a $45k/6.75%/10y loan, adding $100/month can save ≈ $4,200 and cut the term to ~7.9 years.

Your exact savings depend on balance, APR, and remaining term.

3. Does the government shutdown affect my student loan payments?

Generally balances and due dates don’t change because of a shutdown, but administrative delays (processing, support) can occur.

If your income is disrupted, contact your servicer about temporary hardship options and keep automated payments on track if possible.

4. What’s the best way to automate extra payments?

Set autopay for the minimum, then add a recurring transfer labeled “apply to principal”.

Bi-weekly scheduling (half-payment every two weeks) effectively creates one extra payment per year with minimal friction.

5. Is refinancing federal loans safe?

Refinancing federal loans into a private loan may lower your APR, but you’ll lose federal protections (IDR plans, forgiveness options, deferment/forbearance benefits).

Consider refinancing only if you’re confident you won’t need those programs and the savings are substantial.

Conclusion + Next Steps

With rates slowly trending down, now is the perfect time to take action.

The key to faster payoff isn’t timing the market — it’s making consistent, smart extra payments today.

Even small contributions toward your principal can turn into thousands in savings over time.

💡 Next Steps:

• Try the

Loan Payoff Calculator

to see how small changes speed up your debt-free journey.

• Estimate your interest savings with our

Loan Interest Calculator.

For more trusted information and official guidance, visit: