Car Loan Payoff Calculator – Learn How to Save on Auto Loans

Car loan payoff calculator guidance that shows you how to pay off a car loan early, cut interest, and shorten your term—whether your auto loan is for a new or used car.

We’ll walk through the exact math, the strategies that work in the U.S. market, and the pitfalls to avoid.

In this guide you’ll learn: how APR and term drive total cost, the DIY formula to estimate interest,

and three proven payoff strategies (extra monthly, bi-weekly, and lump sum). When you’re ready to test scenarios,

you can model everything in seconds using our free calculators—no sign-up, no data stored.

Pay Off Early

No Sign-Up • Free

How Car Loans Work

Any auto loan comes down to three levers: principal (amount financed), APR (interest rate), and term (months).

Shorter terms raise the monthly payment but cut total interest. Longer terms lower the payment but increase lifetime cost.

Use a car loan calculator to see the trade-off instantly.

Example figures assume $20,000 financed at 7% APR. Educational estimates only.

New vs. Used — Typical Ranges

Ranges vary by credit score, down payment, state, lender programs, and incentives.

Worked Example

Finance $20,000 at 7% APR for 72 months → monthly ≈ $341, total interest ≈ $4,551, total paid ≈ $24,551.

Shortening to 60 months raises the monthly to ≈ $396 but cuts interest to ≈ $3,761.

Smart U.S. Tips

- Down payment lowers principal and may improve APR—target ≥ 10–20% if possible.

- Pre-approval from a bank/credit union gives negotiating power vs. dealer financing.

- Autopay discounts (0.25%–0.5%) exist at many lenders—ask for them.

- Prepayment penalties are uncommon for auto loans, but read your contract.

- Add-ons (gap/warranty) rolled into the loan increase interest cost—compare cash prices.

Manual Formula (DIY Method)

Prefer to sanity-check the math yourself? Here’s a quick way to estimate how much of each payment goes to interest before principal.

Formula: Interest ≈ Balance × APR ÷ 12

Example inputs

- Loan balance: $15,000

- APR: 6%

Monthly interest (est.)

$15,000 × 0.06 ÷ 12 = $75

That ~$75 is the interest portion in the first month; the rest of your payment reduces principal.

Term Impact (36 vs 72 months)

Figures are educational estimates for $15,000 at 6% APR. Your lender’s amortization may differ slightly.

Ready to see your exact payoff date?

Skip the manual math and model real scenarios in seconds. Our free

Loan Payoff Calculator shows monthly payment, total interest, and how

extra payments or a lump sum can shave months off your car loan—no sign-up, no data stored.

Real Example: Use Our Car Loan Payoff Calculator to Save Faster

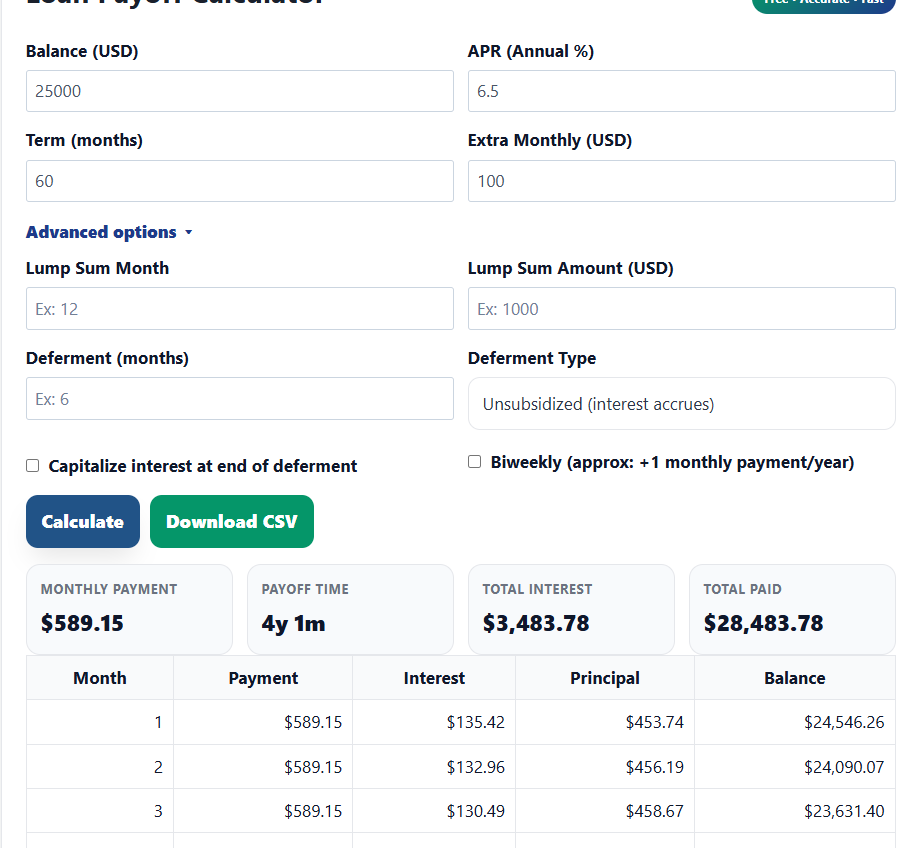

Below is a realistic U.S. auto loan: $25,000 at 6.5% APR over 60 months. See how small changes—

extra monthly payments or a one-time lump sum—can shorten your payoff and cut interest. Try the numbers yourself in

our free Loan Payoff Calculator.

Scenario 1 — Standard Payments (no extras)

- Inputs: Balance $25,000 • APR 6.5% • Term 60 months • Extra Monthly $0

- Results: Monthly ≈ $489.15 • Payoff ≈ 5 years • Total Interest ≈ $4,349.22

Baseline: $25,000 at 6.5% for 60 months → monthly about $489, total interest ≈ $4,349.

Scenario 2 — Add $100 Extra Each Month

Set Extra Monthly = $100. Your payoff drops to about 4y 1m and total interest to ≈ $3,483.78

– saving roughly $865 versus minimums.

Add $100/month: payoff ≈ 4y 1m • total interest ≈ $3,484 • saves ≈ $865.

Scenario 3 — $2,000 Lump Sum in Month 12

In Advanced options, set Lump Sum Month = 12 and Lump Sum Amount = $2,000.

Your payoff becomes about 4y 7m and total interest ≈ $3,787.01 – saving ≈ $562.

Lump sum $2,000 at month 12: payoff ≈ 4y 7m • total interest ≈ $3,787 • saves ≈ $562.

⚠️ Heads-up: Some lenders (especially a few credit unions) may charge prepayment penalties. Most auto loans don’t,

but always check your contract before making extra payments or a lump sum.

Try Your Own Numbers in Our Free Tool

No sign-up, no data stored. Model extra monthly payments, bi-weekly schedules, and one-time lump sums—then download the full amortization (CSV).

Strategies to Pay Off Your Car Loan Faster

Three proven ways to cut time and interest: extra monthly payments, a bi-weekly schedule, and a

lump-sum payment. Try each option in our

car loan payoff calculator to see your exact debt-free date and savings.

1) Extra Monthly Payments

Add a fixed amount to every payment (e.g., +$100 or +$200). Using our baseline example, adding $100 cut the

timeline to ~4y 1m and saved about $865 in interest. Doubling to $200 generally chops the term to

roughly ~3–3.5 years and slashes total interest (run your numbers in the tool).

2) Bi-Weekly Payments

Pay half the monthly amount every two weeks—effectively ~13 monthly payments per year.

This often trims 3–6 months off your schedule and saves hundreds in interest.

Toggle Bi-weekly in the calculator and watch the payoff date move instantly.

3) Lump-Sum (Bonus or Tax Refund)

Dropping a one-time payment early in the term—say $2,000 at month 12—reduces principal immediately.

In our example it shortened the plan to ~4y 7m and saved about $562 in interest.

The earlier the lump sum, the bigger the impact.

Example scenario: $25,000 • 6.5% APR • 60-month term. Numbers are illustrative—use the tool for exact results.

| Strategy | How It Works | Estimated Outcome* | Best For |

|---|---|---|---|

| Baseline (no extras) | Standard monthly schedule | Payoff ≈ 5y • Total interest ≈ $4,349 | Tight budgets |

| + $100/mo extra | Add a fixed surplus to each payment | Payoff ≈ 4y 1m • Save ≈ $865 | Steady cash flow |

| + $200/mo extra | Double the surplus | Payoff ≈ ~3–3.5y • Interest cut deeply | Aggressive payoff |

| Bi-weekly | Half-payment every 2 weeks (~13/mo per year) | Finish ~3–6 months early • Save hundreds | Aligning with paychecks |

| Lump sum $2,000 @ month 12 | One-time principal reduction | Payoff ≈ 4y 7m • Save ≈ $562 | Bonuses / tax refunds |

*Illustrative only. For your exact payoff date and totals, use our

pay off car loan early calculator.

Ready to model your own auto loan?

Open our free tool to test extra payments, bi-weekly schedules, or a lump sum, and download the full amortization as CSV.

Case Scenarios — How Small Tweaks Change Your Payoff

To make the math concrete, here are three scenarios for a typical U.S. auto loan:

$10,000 financed at 6.5% APR over 60 months. See how extra monthly payments or a one-time

lump sum shift your debt-free date and total interest.

Case 1 — Baseline (no extras)

- Inputs: $10,000 • 6.5% APR • 60 months • Extra Monthly $0

- Monthly Payment: ≈ $195.66

- Payoff Time: 60 months

- Total Interest: ≈ $1,739.69

Case 2 — Add $300 Extra per Month

- Payment Sent: ~$195.66 + $300 = $495.66 each month

- New Payoff Time: ≈ 22 months (about 3+ years faster)

- Total Interest: ≈ $618.77

- Interest Saved vs. Baseline: ≈ $1,120.92

Case 3 — $2,000 Lump Sum (Month 12)

- Monthly Payment: stays ~$195.66

- New Payoff Time: ≈ 48 months (1 year earlier)

- Total Interest: ≈ $1,229.73

- Interest Saved vs. Baseline: ≈ $509.96

Quick comparison (Baseline vs. +$300 Extra vs. $2,000 Lump Sum @ month 12)

| Scenario | Monthly Sent | Payoff Time | Total Interest | Interest Saved |

|---|---|---|---|---|

| Baseline | $195.66 | 60 mo | $1,739.69 | — |

| + $300 Extra | $495.66 | 22 mo | $618.77 | $1,120.92 |

| $2,000 Lump @ m12 | $195.66 | 48 mo | $1,229.73 | $509.96 |

Assumes $10,000 at 6.5% APR. Figures are illustrative; your lender’s amortization may vary. For exact numbers, use our calculator and export the schedule.

The 20/3/8 Rule for Car Loans

Financial experts in the U.S. (including Ramsey Solutions) often recommend the

20/3/8 rule for car loans to keep your auto debt under control. It’s a quick formula that tells you if your

financing plan is safe—or if you’re likely to overpay thousands in interest.

- 20% down payment: Always put at least 20% down to avoid being upside down on the loan.

- 3-year loan: Aim for a term no longer than 36 months (shorter loans = less interest).

- ≤ 8% of monthly income: Keep your car payment under 8% of your take-home pay.

⚠️ If you break the 20/3/8 rule—say you finance 100% of the car over 72 months—your monthly payment might look smaller,

but you’ll likely pay thousands more in interest and risk negative equity if the car depreciates faster than you pay it down.

Want to test your own budget? Try our

car loan calculator and see if your numbers fit the 20/3/8 guideline.

Common Mistakes to Avoid with Car Loans

Many drivers end up paying more than necessary because of simple mistakes when managing their auto loans.

Here’s what to watch for if you want to pay off a 72-month car loan early or avoid hidden costs.

- Relying only on minimum payments: Stretching out the loan means more interest and slower progress.

Even small extra payments make a big difference. - Extending to 72–84 months: Longer terms lower the monthly payment, but you’ll pay thousands more in

interest. Ask yourself: is it really better to payoff a car loan early or drag it out? - Ignoring prepayment penalties: Some lenders, especially smaller banks or credit unions,

may charge fees for early payoff. Always check your contract. - Forgetting insurance & fees: Don’t overlook mandatory insurance, GAP coverage, or administrative

fees that raise the true cost of ownership.

Tip: Always run your numbers in a trusted car loan payoff calculator.

These tools are accurate enough to estimate your payoff time and interest, but results may vary slightly depending

on how your lender compounds interest.

Car Loan Payoff Calculator — FAQs

Q1. What is a car loan payoff calculator?

It’s a tool that shows how long it will take to pay off your auto loan, how much interest you’ll pay,

and how early payoff or extra payments change the numbers. Many drivers even export results to

Excel for tracking, making it similar to a car loan payoff calculator Excel.

Q2. How can I pay off my car loan early?

The fastest ways are extra monthly payments, switching to a bi-weekly schedule, or applying a lump sum

(bonus, tax refund). Our auto calculator loan helps you model these strategies instantly.

Q3. Do extra payments reduce interest?

Yes. Every extra dollar goes directly to principal, which reduces future interest charges and shortens

the loan term. Try adding $100–$200 in the loan calculator for car and watch the payoff date move closer.

Q4. Should I refinance or pay off early?

Refinancing makes sense if you can drop your APR significantly. But if you’re already close to payoff,

adding extra payments is usually simpler and cheaper.

Q5. Are online calculators accurate?

Most car loan payoff calculators use the same amortization formulas lenders do. They’re accurate for

estimating payoff time and interest, but always confirm with your lender for exact totals.

Conclusion: Take Control of Your Auto Loan

Paying off your car loan early is one of the smartest financial moves you can make. Whether you use

small extra payments, a bi-weekly schedule, or a lump sum, the savings add up fast. Our free

car loan payoff calculator helps you visualize the impact instantly and compare

strategies. For drivers focused on maximizing savings, an early payoff auto loan calculator

ensures you see the difference between sticking to minimums and accelerating your debt-free date.

Whether it’s a new car or a used one, understanding how a car loan early payoff calculator works

gives you the upper hand before signing or refinancing. Use it as a decision-making tool—not just a calculator.

Ready to explore more free tools to master your finances?

- Student Loan Payoff Calculator — see how faster payments reduce years off your student debt.

- Credit Card Interest Calculator — calculate APR charges by day or month.

- Minimum Payment Calculator — understand how long minimum-only payments keep you in debt.

📘 For more guidance, check the official

CFPB Auto Loans Guide.