Loan Interest Calculator — Calculate APR, Total Interest & Payments

Interest is the price you pay for borrowing money—and understanding how it works can save you thousands of dollars over the life of a loan. Whether you’re financing a car, a home, or using a personal loan, the interest you pay depends on much more than just the advertised rate. That’s why using a loan interest calculator is essential before committing to any financial agreement.

Many borrowers look only at the APR or “annual percentage rate,” but the true cost of a loan also depends on compounding frequency (monthly, daily, or annually), upfront fees, and even penalties for early payoff. A loan that looks cheaper on paper could end up costing more once these details are factored in. Manually crunching the numbers is complicated and prone to mistakes—that’s where our calculator steps in.

Our interest calculator loan tool makes it easy to see the full picture. Simply enter your loan amount, APR, term length, and repayment frequency, and you’ll instantly get:

- Accurate monthly payment or payment per period.

- Total interest cost over the entire loan term.

- Effective Annual Rate (APY) based on compounding.

- APR adjusted for fees like origination or points.

What makes this APR calculator loan unique is its flexibility. You can model extra monthly payments to see how fast you can become debt-free, add variable rate changes to account for adjustable loans, and include fees or points to calculate the real effective cost. The calculator also provides a full amortization schedule so you can track how each payment reduces your balance month by month.

Best of all, it’s completely free, accurate, and instant. No sign-ups, no hidden costs—just real numbers you can rely on when making one of life’s biggest financial decisions. Whether you’re planning a mortgage, comparing car loans, or refinancing student debt, this calculator gives you the clarity you need.

👉 Try our Loan Interest Calculator now — free, accurate, and built for smarter financial planning.

Loan Interest Calculator — Premium

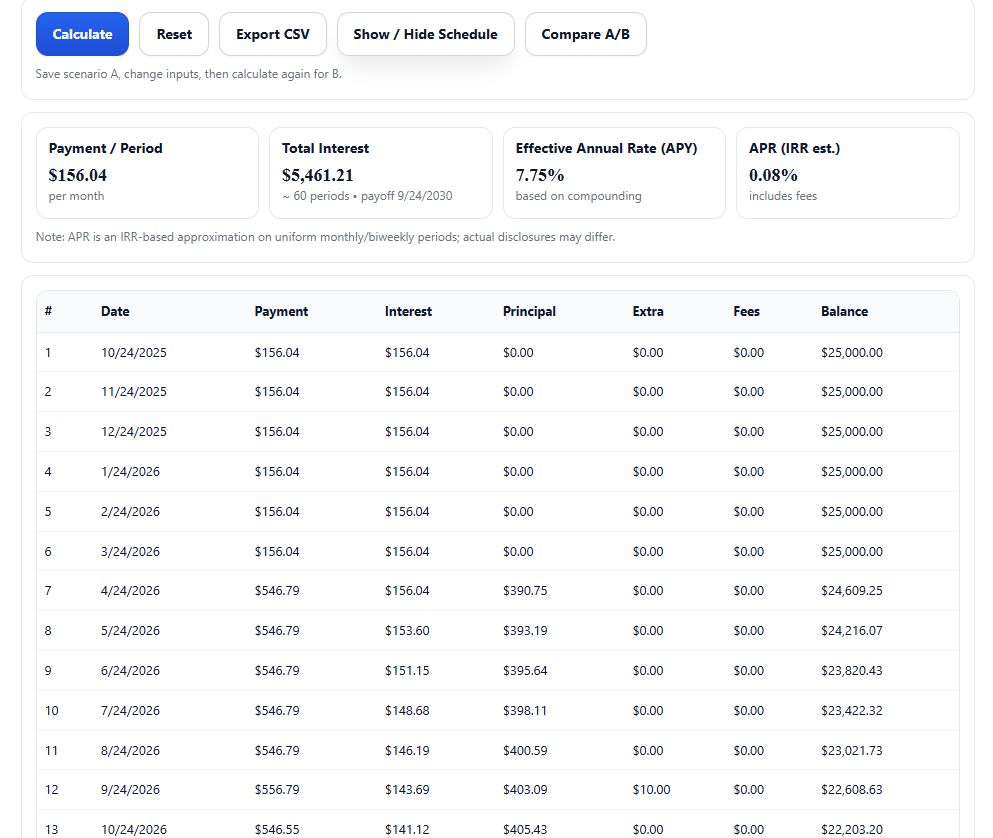

Payment / Period

Total Interest

Effective Annual Rate (APY)

APR (IRR est.)

Understanding Loan Interest Formulas

While our Loan Interest Calculator does the heavy lifting instantly, it’s useful to understand

the math behind loan interest. Knowing the formulas helps you double-check lender offers and

recognize how changes in APR, term length, or fees affect your payments.

Basic Formula for Loan Payment

The standard amortization formula to calculate the fixed payment per period is:

P = [ r × PV ] ÷ [ 1 – (1 + r)-n ]

- P: Payment per period (monthly, if compounding monthly).

- PV: Present Value (loan principal).

- r: Periodic interest rate (APR ÷ 12 for monthly).

- n: Total number of payments (months × years).

Worked Example

Suppose you borrow $25,000 at an APR of 7.5% for 60 months (5 years).

The monthly rate is 0.075 ÷ 12 = 0.00625.

Plugging into the formula:

P = [ 0.00625 × 25,000 ] ÷ [ 1 – (1 + 0.00625)-60 ] P ≈ $500.95 per month

Over 60 months, that’s roughly $30,057 total paid, of which about $5,057 is interest.

Notice how this lines up with what the calculator shows automatically.

✅ By combining the manual formula with the Loan Interest Calculator, you can

quickly validate numbers and adjust scenarios with extra payments, variable rates, or fees.

Why Compounding & APR Matter

When you borrow money, it’s not just about the advertised rate. How interest is calculated can dramatically

change the true cost of your loan. This is why understanding the difference between simple interest

and compound interest is essential. Our interest rate calculator and APR calculator loan

functions help you see the full picture instantly.

Simple Interest

Simple interest is straightforward: it’s calculated only on the original loan amount (principal).

If you borrow $10,000 at 6% simple interest for 3 years, the math is:

Interest = Principal × Rate × Time Interest = 10,000 × 0.06 × 3 = $1,800 Total to repay = $11,800

Compound Interest

Compound interest charges interest on both the original principal and on accumulated interest.

This makes borrowing more expensive — and the frequency of compounding matters a lot.

The formula is:

A = P × (1 + r/n)n×t Where: A = Final amount P = Principal r = Annual interest rate n = Number of compounding periods per year t = Years

Why Frequency Changes the Result

If the same $10,000 loan at 6% is compounded annually, after 3 years you owe:

A = 10,000 × (1 + 0.06/1)1×3 = $11,910

But if it’s compounded monthly:

A = 10,000 × (1 + 0.06/12)12×3 ≈ $11,972

And if compounded daily:

A ≈ $11,976

That’s why checking the APR (which includes fees + compounding) gives a more realistic cost

than just looking at the nominal rate.

✅ Use our loan interest calculator to test different compounding scenarios and see how

daily vs monthly vs annual compounding impacts your repayment. It’s free, accurate, and shows

the results instantly.

Practical Examples & Scenarios (Case Studies)

Use the loan interest calculator to test real-world scenarios. Small changes in APR, term, fees, or extra payments can shift your total cost by hundreds of dollars. These examples show how to read the results and act with confidence.

Example 1 — Standard Fixed Loan

$18,500 financed for 48 months at 6.90% APR (monthly compounding).

- Payment per month ≈ $442.15

- Total interest ≈ $2,723.09

- Total paid ≈ $21,223.09

Insight: Even at a mid-single-digit APR, interest adds up over four years—check if a shorter term is affordable.

Example 2 — Same Loan with Extra Payments

Same as Example 1, but add $50 extra each month (a classic use of a loan interest calculator with extra payments).

- Loan paid off in ≈ 43 months (vs. 48)

- Total interest ≈ $2,404.22 (saves ≈ $318.87)

- Months saved: 5

Insight: Small extra payments accelerate payoff and reduce interest without refinancing.

Example 3 — Lower APR with Fees vs. Higher APR with No Fees

Compare $20,000 over 60 months:

- Offer A: 6.49% APR, $450 origination fee (not financed)

- Offer B: 6.89% APR, $0 fees

- Offer A monthly ≈ $391.23, total cost ≈ $23,923.76 (incl. fee)

- Offer B monthly ≈ $394.99, total cost ≈ $23,699.21

Insight: Despite the lower APR, Offer A is ≈ $224.55 more expensive overall because of the fee. Always compare total cost, not just headline APR.

Use the loan interest calculator to plug in your own numbers, add fees or extra payments, and confirm which offer yields the lowest true cost. Then export the amortization table to Excel for your records.

5. Popular Use Cases in the U.S.

Loans are not “one size fits all” in the U.S. market. Each loan type comes with its own terms, risks,

and opportunities. That’s why using an accurate loan interest calculator or

interest rate calculator can save borrowers thousands of dollars over the lifetime of a loan.

Here are the most common use cases where Americans rely on such tools:

1. Auto Loans

Car financing is one of the most frequent loan types in the U.S. Dealers often promote “low monthly payments,”

but the real cost depends on APR, loan term, and hidden fees. With an online calculator, you can compare a

60-month loan at 6.9% APR versus a 72-month loan at 7.5% and instantly see how much extra you’ll pay in interest.

2. Mortgages

Home loans are typically the largest financial commitment for U.S. families. A small change in interest rates—say,

6.5% vs. 6.25% on a 30-year mortgage—can add up to tens of thousands in lifetime payments. Using a mortgage

interest calculator helps homeowners decide between fixed, adjustable, 15-year, or 30-year options.

3. Student Loans

With tuition costs rising, student debt is one of the heaviest burdens in the U.S. A

loan interest calculator can show how repayment terms (10 years vs. 20 years),

income-driven plans, or refinancing affect total payoff and interest charges. It also highlights

how extra payments can reduce debt faster.

4. Personal Loans

Whether for debt consolidation or large expenses, personal loans often come with origination fees

and higher APRs compared to secured loans. Running the numbers in an interest rate calculator

makes it easy to spot when a “low APR” isn’t actually the cheapest option once fees are added.

⚡ Before signing any loan agreement—auto, home, student, or personal—run the numbers with our

Loan Interest Calculator to uncover the real cost and make smarter financial decisions.

6. Frequently Asked Questions — Loan Interest Calculator

Below you’ll find answers to the most common questions about calculating loan interest, APR, and payoff schedules.

These FAQs are designed to help U.S. borrowers understand how loans really work and how to use our

loan interest calculator to save money.

1. What is a loan interest calculator?

A loan interest calculator is a free online tool that shows you how much interest you’ll pay over the life of a loan. It helps estimate monthly payments, total interest, APR, and how extra payments or fees affect costs.

2. How do you calculate loan interest with extra payments?

Simply enter your principal, APR, and term, then add any monthly or lump-sum extra payments in the calculator. The tool will adjust your payoff date and show how much interest you save compared to regular payments.

3. What’s the difference between APR and interest rate?

The interest rate is the cost of borrowing money. APR (Annual Percentage Rate) includes the interest rate plus fees like origination or points. APR is always the more accurate measure of the true cost of a loan.

4. Does compounding affect loan payments?

Yes. Compounding frequency (monthly, quarterly, daily) determines how often interest is applied to your balance. More frequent compounding means slightly higher total interest.

5. How to calculate interest on a loan?

For simple interest: Principal × Rate × Time. But most loans use compound interest, which is why a loan interest calculator is more accurate than manual math.

6. How to calculate car loan interest?

Enter the car price (minus down payment), APR, and term into our calculator. It will show your monthly payment and total interest. This helps compare dealer financing vs. credit union rates.

7. How to calculate interest rate on a loan?

If you know the loan amount, payment, and term, you can back-calculate the effective interest rate. Our tool does this automatically, giving you the APR and APY side by side.

8. How to calculate auto loan interest?

Auto loans often advertise low rates but include fees. Enter both APR and any fees in the calculator to see the real total cost. This way, you can decide whether a 0.9% dealer promo is better than a 3% credit union loan with no fees.

9. How do I calculate interest on my loan?

Just plug your numbers into the calculator: principal, term, APR, and frequency. It’s faster and more accurate than manual formulas, especially if extra payments or fees are involved.

10. What is 5% interest on a $10,000 loan?

At 5% simple interest for one year, it’s $500. With compound interest over multiple years, the amount will be higher. The calculator shows exact results based on your term and compounding schedule.

11. What is the monthly payment on a $500,000 loan at 7%?

On a 30-year mortgage, the monthly payment is roughly $3,326 before taxes and insurance. Enter these values in the calculator for an exact breakdown of principal vs. interest.

12. Is 10% interest a lot on a loan?

Yes. In the U.S., 10% is high for mortgages or auto loans but normal for some personal loans or credit cards. Always compare offers with a loan interest calculator before accepting.

13. How do extra payments change my loan payoff?

Extra monthly or lump-sum payments reduce your balance faster, which cuts interest and shortens the term. Our tool shows side-by-side scenarios with and without extra payments.

14. Which is better — APR or interest rate?

APR is always better for comparison because it includes both the interest rate and fees. A loan with a lower APR is usually cheaper overall, even if the interest rate alone looks higher.

7. Conclusion: Why Every Borrower Needs a Loan Interest Calculator

Understanding how interest really works can be the difference between saving thousands of dollars or overpaying on your loan.

Many borrowers focus only on the headline rate, but true costs depend on compounding, fees, and repayment frequency.

That’s why using a reliable loan interest calculator is essential — it gives you the full picture, not just a simple estimate.

With our tool, you can model scenarios like extra payments, lump sums, or interest-only months.

Whether you’re testing a mortgage, car loan, personal loan, or student loan, the calculator adapts to your situation.

If you want to see how much faster you can become debt-free, try the built-in interest only loan calculator option

or compare multiple loans side by side with our Loan Comparison Calculator.

Instead of guessing or relying on lender promises, you can run the numbers yourself in seconds.

Export results to Excel, test “what if” scenarios, and make fully informed decisions before signing any loan agreement.

Knowledge is power — and in finance, that power translates into lower costs and smarter borrowing.

💡 Explore More Free Tools

- Loan Payoff Calculator — see how quickly you can pay off debt with extra payments.

- Loan Comparison Calculator — compare banks and lenders side by side with fees included.

- Loan Refinance Calculator — evaluate if refinancing reduces your rate and monthly cost.

📚 Official Resources

- Federal Student Aid (studentaid.gov) — repayment plans, forgiveness programs, and IDR calculators.

- Consumer Financial Protection Bureau (CFPB) — official loan guides and borrower protections.

✅ Take control of your debt — calculate true loan interest today.

Example of the Output Section — review monthly payments, APR, and export a full amortization schedule.

Example of the Output Section — review monthly payments, APR, and export a full amortization schedule.