Loan Payoff Calculator | Plan Your Payments, Cut Interest, Pay Off Faster

Our loan payoff calculator shows your monthly payment, total interest, and exact payoff date in seconds.

Toggle extra monthly payments, a one-time lump sum, deferment (subsidized or unsubsidized),

and an approximate biweekly schedule. Download the full amortization schedule (CSV) to analyze

every month. Works great for student, personal, auto, and mortgage loans.

- Monthly breakdown: payment, interest, principal, and remaining balance.

- Extra payments: add a fixed extra each month to shorten your payoff time.

- Lump sum: test a one-time payment and see how much interest you save.

- Deferment: compare subsidized vs. unsubsidized interest accrual.

- Biweekly option (approx): ~one extra monthly payment per year.

- CSV export: download the full amortization schedule for record-keeping.

Note: Results are for educational purposes. Actual lender rules and compounding may vary.

Try the Loan Payoff Calculator Now

Enter your balance, APR, and term to see monthly payments, total interest, and payoff time instantly.

Add extra payments, test lump sums, or switch to a biweekly schedule and download the full amortization table (CSV).

Loan Payoff Calculator

Free • Accurate • FastMonthly Payment

Payoff Time

Total Interest

Total Paid

Notes: Standard monthly amortization. Biweekly uses a practical approximation (adds ~1 monthly payment/year). Educational estimates only.

How to Use the Loan Payoff Calculator

Enter your loan details to see monthly payment, payoff time, total interest, and total paid.

You can add extra monthly payments, test a one-time lump sum, toggle deferment (subsidized/unsubsidized), or try an

approximate biweekly schedule.

APR

Term (months)

Extra Monthly

Lump Sum

Deferment

Biweekly (approx)

- Balance: your remaining principal.

- APR: annual percentage rate; the calculator converts it to a monthly rate automatically.

- Term: total number of months in your loan.

- Extra Monthly: add a fixed amount to shorten payoff time and reduce interest.

- Lump Sum: test a one-time payment at any month to see interest savings.

- Deferment: choose subsidized (no interest accrues) or unsubsidized (interest accrues).

- Biweekly: pays half every two weeks—roughly one extra monthly payment per year.

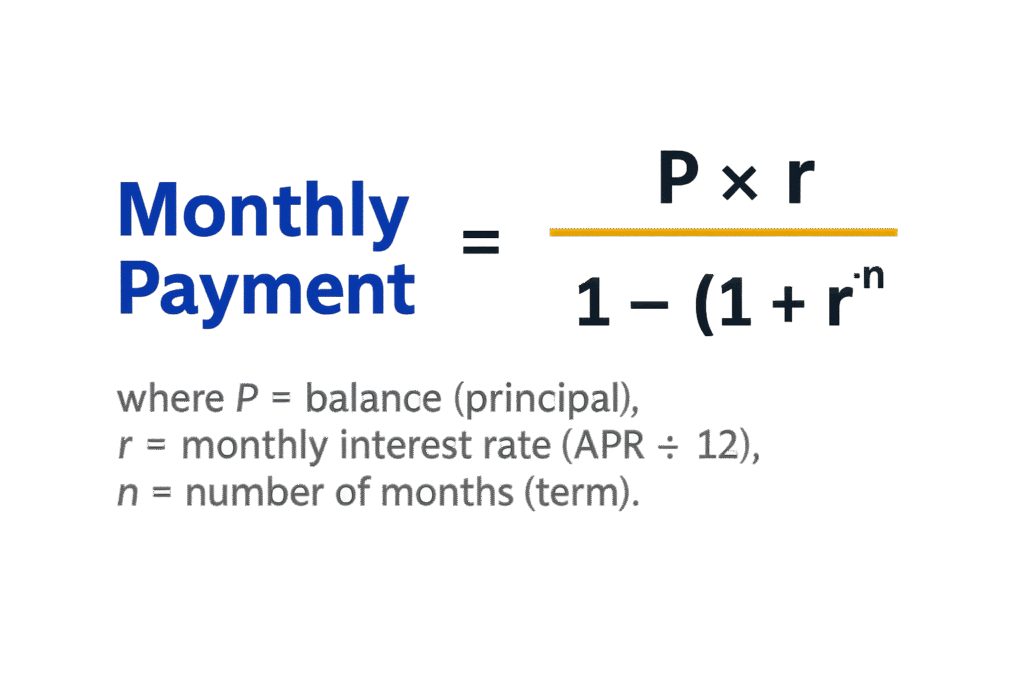

where P = balance, r = monthly interest rate (APR ÷ 12), n = number of months.

Example: $25,000 @ 5.99% APR, 72 months

Monthly Payment ≈ $400.54

Payoff Time ≈ 6y 6m

The calculator outputs four key numbers: Monthly Payment, Payoff Time,

Total Interest, and Total Paid. Use CSV export to download the full

amortization schedule for every month.

Student Loan Payoff Calculator

Our student loan payoff calculator helps you estimate monthly payments, interest, and payoff

time. Enter your balance, APR, and loan term — then add extra payments or a one-time lump sum

to see how quickly you can become debt-free. Perfect for both federal and private student loans.

Example: $40,000 student loan at 6.8% APR, 120 months (10 years).

- Monthly Payment ≈ $460.32

- Total Interest ≈ $15,238

- Total Paid ≈ $55,238

| Strategy | Payoff Time | Interest Saved |

|---|---|---|

| Standard (no extra) | 10 years | – |

| + $100 Extra Monthly | 8y 3m | ≈ $3,200 |

| Biweekly Payments | ≈ 9y 4m | ≈ $1,500 |

| One-time $5k Lump Sum | ≈ 9y | ≈ $1,800 |

Top 5 Tips for Paying Off Student Loans

- Make extra monthly payments — even $50–$100 can cut years off your loan.

- Explore IDR plans (Income-Driven Repayment) for federal loans if monthly cash flow is tight.

- Switch to biweekly payments (~1 extra payment per year).

- Consider refinancing if you have good credit and want a lower APR.

- Know your loan type — subsidized loans pause interest in deferment, unsubsidized keep accruing.

FAQ: Is it wise to pay off student loans early?

It depends. Paying off early saves interest and brings peace of mind. But for federal loans, you may lose access

to forgiveness programs and IDR protections. Many borrowers balance extra payments with maintaining eligibility

for federal benefits.

Personal Loan Payoff Calculator

Our personal loan payoff calculator helps you see how quickly you can eliminate debt and how much

interest you’ll save. Personal loans are often used for debt consolidation, home improvements, or

covering unexpected expenses. Enter your balance, APR, and term, then try adding extra monthly payments

or a lump sum to see the impact.

Example: $10,000 personal loan at 8% APR, 36 months.

- Monthly Payment ≈ $313.36

- Total Interest ≈ $1,281

- Total Paid ≈ $11,281

| Strategy | Payoff Time | Interest Saved |

|---|---|---|

| Standard (no extra) | 36 months | – |

| + $50 Extra Monthly | 32 months | ≈ $190 |

| Biweekly Payments | ≈ 34 months | ≈ $120 |

| One-time $1k Lump Sum | ≈ 33 months | ≈ $140 |

Top 5 Tips for Paying Off Personal Loans

- Check for prepayment penalties before making early payments.

- Add small extra monthly payments — they reduce interest and shorten payoff time.

- Consider refinancing if rates have dropped or your credit improved.

- Keep an emergency fund so extra payments don’t leave you cash-strapped.

- Protect your credit score by making all payments on time, even if you plan to pay off early.

FAQ: Is it possible to pay off a personal loan early?

Yes, most lenders allow early payoff — but always check for prepayment penalties. Paying off early can save

significant interest, improve your debt-to-income ratio, and boost your financial flexibility.

Auto Loan Payoff Calculator

Use our auto loan payoff calculator to estimate car payments, total interest, and your payoff date.

Enter the balance, APR, and term, then try extra monthly payments, a lump sum, or an

approximate biweekly schedule to see how fast you can pay off your car.

Example: $18,000 auto loan at 6.5% APR, 60 months (5 years).

- Monthly Payment ≈ $352.19

- Total Interest ≈ $3,131

- Payoff Time = 5 years

| Strategy | Payoff Time | Interest Saved* |

|---|---|---|

| Standard (no extra) | 60 months | – |

| + $50 Extra Monthly | ≈ 52 months (4y 4m) | ≈ $460 |

| Biweekly Payments (≈ +1 monthly/yr) | ≈ 55 months (4y 7m) | ≈ $290 |

| One-time $2,000 Lump Sum (month 12) | ≈ 53 months (4y 5m) | ≈ $550 |

*Savings vs. standard schedule. Biweekly uses a practical approximation (adds ~1 monthly payment per year).

Top 5 Tips for Paying Off a Car Loan

- Know your true APR: dealership add-ons and markups can inflate your rate — compare offers from your bank/credit union.

- Make a lump sum early: paying a chunk in the first year cuts interest the most.

- Try biweekly payments: roughly one extra monthly payment per year with minimal friction.

- Pay a little extra each month: even $25–$50 can shave months off a 5-year loan.

- Avoid “payment holidays” or deferment: interest keeps accruing, so total cost goes up.

FAQ: How to pay off a 5-year car loan in 3 years?

Increase your payment enough to amortize over ~36 months (use the calculator to solve for payment), or combine

biweekly payments with consistent extra monthly amounts and an early lump sum. Refinancing to a lower APR can

reduce the required payment to hit the 3-year target.

Mortgage Payoff Calculator

Our mortgage payoff calculator helps homeowners plan for long-term loans (15–30 years).

Enter your balance, APR, and term to see monthly payments, payoff date, and interest costs.

Test extra monthly payments, a one-time lump sum, or a biweekly schedule to discover how much faster you can be mortgage-free.

Example: $250,000 mortgage at 6% APR, 30 years (360 months).

- Monthly Payment ≈ $1,499.00

- Total Interest ≈ $289,595

- Total Paid ≈ $539,595

| Strategy | Payoff Time | Interest Saved* |

|---|---|---|

| Standard (no extra) | 30 years | – |

| + $200 Extra Monthly | ≈ 25 years | ≈ $60,000 |

| Biweekly Payments | ≈ 25y 8m | ≈ $55,000 |

| One-time $20k Lump Sum (year 5) | ≈ 27 years | ≈ $35,000 |

*Savings vs. standard 30-year schedule. Biweekly uses practical approximation.

Top 5 Tips for Paying Off a Mortgage Faster

- Switch to biweekly payments — you’ll make ~1 extra payment each year, saving thousands.

- Refinance when interest rates drop to lock in lower monthly costs and cut total interest.

- Add extra monthly payments (even $100–$200 can shave years off a 30-year loan).

- Use lump sums strategically (bonuses, tax refunds, inheritance) early in the loan term.

- Track total interest to stay motivated and understand the true cost of a mortgage.

FAQ: How to calculate mortgage loan payoff amount?

To calculate a mortgage payoff amount, include your current balance, accrued interest since your last payment, and

any fees. Lenders typically provide an official payoff quote valid for 10–30 days. You can also use our calculator

to estimate payoff scenarios with extra payments or lump sums.

Credit Card & Debt Payoff Calculator

Unlike fixed-term loans, credit cards use revolving credit where balances, interest, and payments

change monthly. Our credit card payoff calculator estimates how long it will take to pay off balances

based on your APR and payment strategy. Add extra monthly payments or compare snowball vs. avalanche

methods to plan the fastest debt payoff.

Example: $5,000 credit card balance at 18% APR, minimum payment = 3% of balance.

- Pay minimum only: ≈ 17 years, total interest ≈ $6,300+

- Fixed $200 monthly: ≈ 32 months, interest ≈ $1,290

| Strategy | Payoff Time | Interest Saved |

|---|---|---|

| Minimum only (3%) | ≈ 17 years | – |

| Fixed $200 Monthly | ≈ 32 months | ≈ $5,000 |

| Snowball (smallest balance first) | Varies | Behavioral motivation |

| Avalanche (highest APR first) | Fastest payoff | Max interest savings |

| Balance Transfer (0% intro APR) | 12–18 months typical | High if debt paid off before promo ends |

Top 5 Tips for Paying Off Credit Cards & Debt

- Choose a method: Snowball for motivation, Avalanche for max savings.

- Consider balance transfer offers (0% APR intro) if you can repay within the promo period.

- Always pay more than the minimum — it’s the only way to make progress.

- Make consistent extra payments (even $50–$100 can cut years off repayment).

- Track progress with CSV export to stay motivated and accountable.

FAQ: Should I pay off credit cards before personal loans?

Generally yes — credit cards have much higher APRs (15–25%) than personal loans (6–12%).

Paying off high-interest revolving debt first saves more money.

But always consider loan terms, prepayment penalties, and your overall financial goals.

Advanced Features of the Calculator

Use the loan payoff calculator extra payments controls to model different strategies:

lump sum, deferment (subsidized/unsubsidized + capitalization),

CSV export for record-keeping, and an approximate biweekly schedule.

Each option changes your payoff time and total interest.

Lump Sum

Biweekly (approx)

Deferment & Capitalization

CSV Export

Baseline: $25,000 @ 5.99% APR, 72 months

Payment ≈ $414.20

Total Interest ≈ $4,822.70

| Option | What it does | Payoff Time | Interest Impact* |

|---|---|---|---|

| Baseline (no extras) | Standard monthly payments only | 72 months | — |

| + $50 Extra Monthly | Adds a fixed amount each month | ≈ 63 months | Save ≈ $632 |

| Biweekly (approx) | ~1 extra monthly payment per year | ≈ 66 months | Save ≈ $455 |

| $2,000 Lump Sum (month 12) | One-time early principal payment | ≈ 66 months | Save ≈ $660 |

| Deferment (3 months, subsidized) | Pause payments; no interest accrues | ≈ 75 months (3-month delay) | ≈ same interest as baseline |

| Deferment (3 months, unsubsidized) | Pause payments; interest accrues & may capitalize | ≈ 77 months | + ≈ $542 interest |

*Impact vs. baseline scenario. Biweekly shown as a practical approximation.

Extra payments: Any extra goes straight to principal, cutting both payoff time and total interest.

Lump sum: Early is best — a one-time payment in the first year has the biggest impact.

Biweekly (approx): Two half-payments every two weeks ≈ 13 full payments per year.

Deferment & capitalization: With unsubsidized loans, interest accrues during deferment and may be added to your balance (capitalized), increasing total interest and extending payoff time.

Loan Payoff Comparison Table

This table highlights key differences between student, auto, personal, mortgage, and credit card debt.

Compare APR ranges, typical terms, and the best strategy to minimize interest

and pay off early. Use this quick reference with our calculators for detailed scenarios.

| Loan Type | Typical APR | Typical Term | Best Strategy |

|---|---|---|---|

| Student Loan | 4% – 7% (federal), 5% – 12% (private) | 10 – 25 years | Extra payments, IDR awareness, refinancing for lower APR |

| Personal Loan | 6% – 15% | 2 – 7 years | Check prepayment penalties, add extra monthly, refinance |

| Auto Loan | 4% – 8% | 3 – 7 years | Lump sum early, biweekly, pay more than minimum |

| Mortgage | 5% – 7% | 15 – 30 years | Refinance, biweekly, extra monthly, early lump sums |

| Credit Card | 15% – 25%+ | Revolving (no fixed term) | Avalanche method, balance transfer, avoid minimum-only |

Pro Tip: Even small extra payments make the biggest difference on long-term loans like mortgages

and high-interest debt like credit cards. Use the calculator to test different strategies.

Frequently Asked Questions

Explore the most common questions about using our loan payoff calculator for personal loans, student loans,

auto loans, mortgages, and credit card debt. Each answer is practical and designed for U.S. borrowers.

Is it wise to pay off a personal loan early?

Yes — paying off early saves interest and lowers your debt-to-income ratio. Just confirm your lender doesn’t charge prepayment penalties.

Is it possible to pay off a personal loan early?

Absolutely. Most lenders allow you to pay more than the minimum or make lump sum payments anytime. Check your loan agreement for terms.

How to pay off a 5-year loan in 3 years?

Make larger payments equal to a 36-month schedule, or combine biweekly payments with lump sums to cut down your loan term.

How to finish a personal loan early?

Add extra monthly payments, refinance to a shorter term, or apply bonuses/tax refunds as lump sums. Always keep an emergency fund.

How to calculate early loan payoff?

Use a loan payoff calculator with extra payments. Enter balance, APR, and term, then add your extra payment amount to see the adjusted payoff date and interest.

How to calculate home loan payoff?

Enter your mortgage balance, APR, and remaining term into the calculator. Add lump sums or extra monthly payments to see new payoff dates.

How to calculate mortgage loan payoff?

Use the amortization formula or our mortgage payoff calculator. It shows your monthly payment, total interest, and how extra payments affect payoff time.

How to calculate loan payoff?

Loan payoff is calculated using balance, monthly interest rate, and remaining term. Our calculator automates the formula for quick results.

How to calculate mortgage loan payoff amount?

Request a payoff quote from your lender. It includes principal, accrued interest, and fees. Our calculator provides an estimate for planning purposes.

Should I pay off credit cards before personal loans?

Yes. Credit cards typically carry higher APRs (15–25%) compared to personal loans (6–12%), so paying them first saves more interest.

What is the best way to pay off student loans early?

Make consistent extra monthly payments, refinance for a lower APR, or switch to biweekly payments. Always consider federal forgiveness options first.

Can refinancing reduce my payoff time?

Yes. Refinancing to a lower APR or shorter term can significantly reduce total interest and help you pay off faster.

Do biweekly payments really save money?

Yes. Making half-payments every two weeks equals 13 full payments per year, reducing both payoff time and interest.

How does deferment affect loan payoff?

Subsidized loans pause interest during deferment, unsubsidized loans continue accruing. Capitalization can increase your total cost.

What’s the difference between snowball and avalanche payoff?

Snowball focuses on paying off the smallest balance first for motivation, avalanche targets the highest APR first for maximum savings.

What is a loan amortization schedule?

It’s a month-by-month breakdown showing how each payment is split between principal and interest. Our calculator generates it with CSV export.

Do extra monthly payments always reduce interest?

Yes, if applied to principal. Even small amounts lower future interest because your balance declines faster.

Can I download my loan payoff schedule?

Yes. Our calculator allows CSV export so you can track month-by-month payments and interest over time.

Conclusion: Plan Smarter, Pay Off Faster

Our Loan Payoff Calculator helps you see exactly how your balance, APR, and payment choices

shape your financial future. Whether it’s student loans, auto loans, personal loans,

mortgages, or credit cards — the tool provides clarity and empowers you to take control of your debt.

Trusted Resources:

- Federal Student Aid (studentaid.gov) – Official info on repayment & forgiveness.

- Consumer Financial Protection Bureau (CFPB) – Guides on loans, credit cards, and debt management.

Take control of your debt with our Loan Payoff Calculator today.

Latest Guides & Calculators

Smart tools and guides to plan your loans, cut interest, and get debt-free faster

average interest rate for personal loan

Average interest rate for personal loan & How to Get the Lowest Rate Understanding how personal loan interest…

loan amortization calculator

Loan Amortization Calculator Estimate your monthly loan payments, total interest, and full amortization schedule. Perfect for personal, auto,…

inflation calculator

Inflation Calculator – U.S. Dollar Value from 1913 to 2026 See how the purchasing power of the U.S.…

navy fed gov shutdown loan

navy fed gov shutdown loan — Financial Relief Options Explained With another potential government shutdown on the horizon,…

how to pay off student loans fast ?

How to Pay Off Student Loans Fast | Proven Strategies + Payoff Calculator With interest rates fluctuating —…

USAA Government Shutdown Loan

USAA Government Shutdown Loan — Emergency Relief Options for Military & Federal Workers A federal government shutdown can…